U.S. stock futures are pointing lower in pre-market trading for Friday, July 1. The Dow Futures are down -9.00 points to 17810.0. The S&P 500 Futures are down -1.75 points to 2088.5. The Nasdaq Futures are lower at 4402.25 for a loss of -4.75 points. The Russell Futures are showing a gain of 1 point at 1148.4.

In overnight trading in the Eastern Hemisphere stocks were mostly higher. China’s Shanghai Composite was higher at 2932.48 for a gain of 2.87 points or 0.10 percent. Japan’s Nikkei 225 was higher at 15682.48 for a gain of 106.56 points or 0.68 percent. Hong Kong’s Hang Seng Index was higher at 20794.37 for a gain of 358.25 points or 1.75 percent. India’s S&P BSE Sensex was higher at 27144.91 for a gain of 145.19 points or 0.54 percent. The FTSE 100 was higher at 6536.74 for a gain of 32.41 points or 0.50 percent. Germany’s DAX was higher at 9709.27 for a gain of 29.18 points or 0.30 percent. France’s CAC 40 was higher at 4248.99 for a gain of 11.51 points or 0.27 percent. The Stoxx Europe 600 was higher at 330.54 for a gain of 0.66 points or 0.20 percent.

Friday’s Factors and Events

Friday’s economic calendar is pretty full despite the holiday weekend. Motor vehicle sales for June will be reported throughout the day. Also accompanying that will be the PMI Manufacturing Index, the ISM Manufacturing Index and Construction Spending. The Baker-Hughes Rig Count will also be reported Friday. At 11:00 AM EST Loretta Mester, Cleveland Federal Reserve Bank President, will be speaking in London on the U.S. economic outlook and monetary policy. At 2:00 PM EST the bond markets will close early for the Fourth of July holiday.

Stocks trading actively in pre-market trading include Leucadia National, Marathon Oil, Visa, Microsoft, Chipotle, Qualcomm, Skyworks Solutions and Western Digital.

No major earnings reports are on the calendar for July 1.

One week after the Brexit vote, markets have mostly recovered. However, Brexit reform will still be a factor and it is likely the Bank of England could lower rates to help stimulate the economy. While this could help the country avoid a recession it could also weigh on the earnings of large banks in the U.K. and push the government’s bonds toward negative which could be adverse factors.

Thursday’s Activity

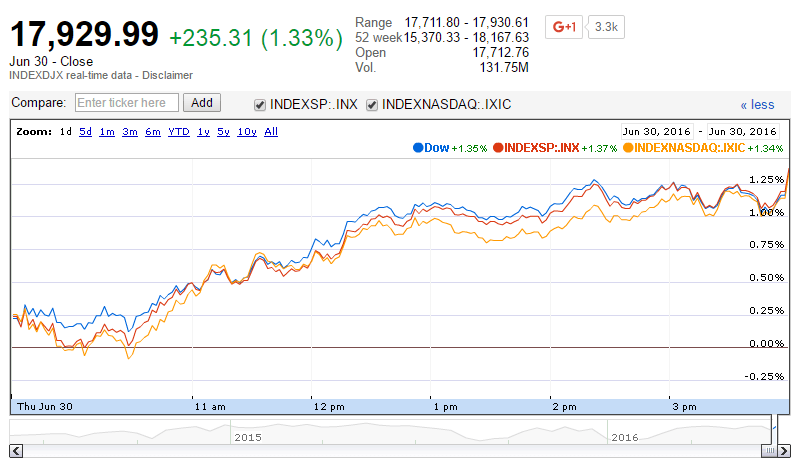

In the U.S., the leading indexes were higher on Thursday. The Dow Jones Industrial Average closed at 17929.99 for a gain of 235.31 points or 1.33 percent. The S&P 500 was also higher, closing at 2098.86 for a gain of 28.09 points or 1.36 percent. The Nasdaq Composite closed higher at 4842.67 for a gain of 63.43 points or 1.33 percent.

For the week, the major indexes were higher. The Dow Jones Industrial Average was up 3.04 percent and the S&P 500 was up 3.02 percent.

Source: DJIA, S&P 500 and Nasdaq Composite. Google Finance.

Other notable U.S. index closes included the small-cap Russell 2000, closing higher at 1151.92 for a gain of 20.31 points or 1.79 percent; the S&P 600 closing at 708.36 for a gain of 14.49 points or 2.09 percent; the S&P 400 Mid-Cap Index closing at 1496.50 for a gain of 28.30 points or 1.93 percent; the S&P 100 closing at 928.13 for a gain of 11.31 points or 1.23 percent; the Russell 3000 closing at 1236.62 for a gain of 17.01 points or 1.39 percent; the Russell 1000 closing at 1161.57 for a gain of 15.62 points or 1.36 percent; and the Dow Jones U.S. Select Dividend Index closing at 611.90 for a gain of 11.75 points or 1.96 percent.