U.S. stock futures are pointing higher in pre-market trading for Tuesday, August 23. The Dow Futures are at 18565.0 for a gain of 46.00 points. The S&P 500 Futures are at 2186.5 for a gain of 5.00 points. The Nasdaq Futures are higher at 4824.5 for a gain of 12.75 points. The Russell Futures are higher at 1241.4 for a gain of 3.30 points.

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 is at 16497.36 for a loss of -100.83 points or -0.61 percent. Hong Kong’s Hang Seng Index is at 22998.93 for a gain of 1.02 points or 0.01 percent. China’s Shanghai Composite is at 3089.71 for a gain of 4.90 points or 0.16 percent. India’s S&P BSE Sensex is at 27990.21 for a gain of 4.67 points or 0.02 percent. In Europe, the FTSE 100 is at 6866.49 for a gain of 37.95 points or 0.56 percent. Germany’s DAX is at 10579.85 for a gain of 85.50 points or 0.81 percent. France’s CAC 40 is at 4422.63 for a gain of 32.69 points or 0.74 percent. The Stoxx Europe 600 is at 343.20 for a gain of 2.77 points or 0.81 percent.

Tuesday’s Factors and Events

New Home Sales and the Richmond Fed Manufacturing Index are the leading reports on the economic calendar for Tuesday. Also on Tuesday the Treasury will hold an auction for 4-week bills and 2-year notes.

Stocks trading actively in the pre-market include the following:

Macy’s

ONEOK

Halliburton

Tesoro Corp.

Newfield Exploration

Regeneron Pharmaceuticals

CF Industries

AES Corp.

Vertex Pharmaceuticals

Mattel

Most companies have reported their second quarter earnings however there are a few earnings reports on the calendar for Tuesday. Best Buy reported earnings before the opening bell. The retail company beat analysts’ estimates for revenue and earnings.

The market is trending higher as second quarter earnings were improved from the first quarter. A more positive outlook for future quarters along with improving GDP growth is also helping stock valuations. Stocks have mostly valued in a rate increase later this year and are pointing higher ahead of Janet Yellen’s speech on Friday at Jackson Hole. The speech will provide more insight on the Fed’s perspective on the economy and timing for the next rate increase.

Monday’s Activity

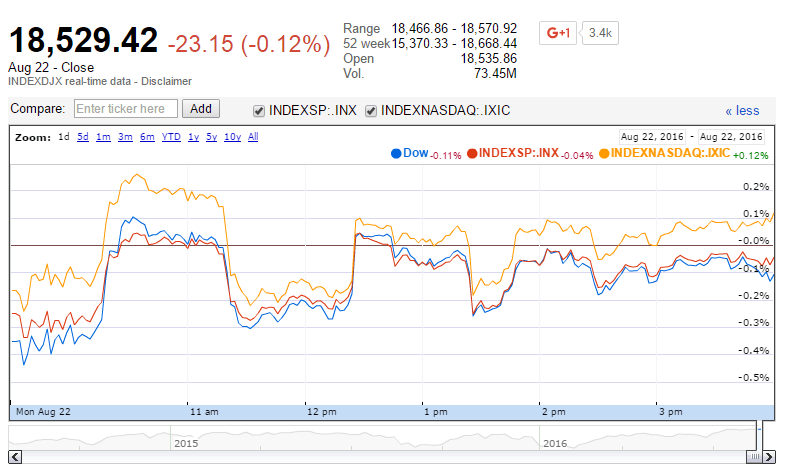

On Monday, stocks were mostly lower. The Dow Jones Industrial Average closed at 18529.42 for a loss of -23.15 points or -0.12 percent. The S&P 500 was also down, closing at 2182.64 for a loss of -1.23 points or -0.06 percent. The Nasdaq Composite closed higher at 5244.60 for a gain of 6.22 points or 0.12 percent.

Source: DJIA, S&P 500 and Nasdaq Composite. Google Finance.

Other notable index closes included the small-cap Russell 2000 Index, higher at 1239.74 for a gain of 2.97 points or 0.24 percent; the S&P 600 Small-Cap Index, higher at 750.77 for a gain of 1.92 points or 0.26 percent; the S&P 400 Mid-Cap Index at 1563.68 for a gain of 0.88 points or 0.06 percent; the S&P 100 Index at 964.15 for a loss of -0.65 points or -0.07 percent; the Russell 3000 Index at 1290.44 for a loss of -0.15 points or -0.01 percent; the Russell 1000 Index at 1209.11 for a loss of -0.39 points or -0.03 percent; and the Dow Jones U.S. Select Dividend Index at 619.69 for a loss of -1.16 points or -0.19 percent.