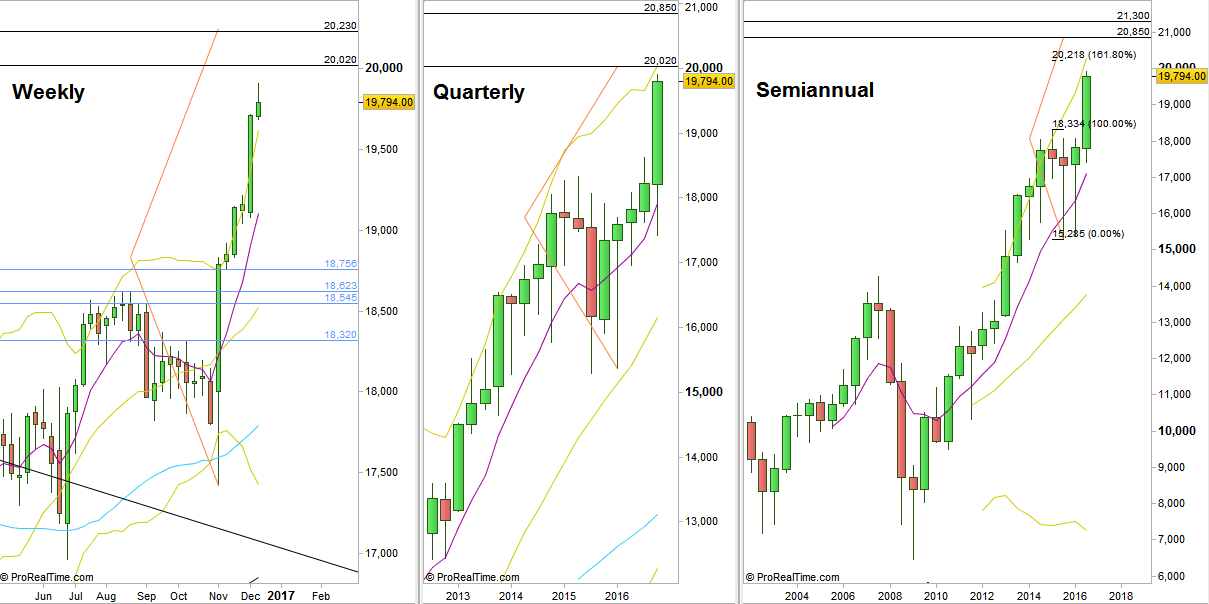

After reaching the post election Daily pinbar’s target, at 19760 right on last Monday, the market consolidated for the rest of the passing week above that target. It was the 6th consecutive week to penetrate the upper Weekly Bollinger band revealing a strong bullish momentum and since the passing week closed outside the upper band, it should continue this sequence for the coming week.

The market is approaching the upper Bollinger band on the Quarterly and the Semiannual timeframes, an important indication as for the strength of the market on these timeframes, only two weeks left for the bars on those timeframes to close.

The closest important target for the current momentum is the Quarterly pinbar of the first Quarter 2016, pointing at 20020, very near to the Quarterly upper Bollinger band. Above that, The next important target is the election week’s Weekly Spring’s target at 20230, quite close to the 20218 level which is the 161.8% extension of the Whole retracement of the last 2 years.

Other longer targets are the last November Monthly spring, target at 21000, and the 2015 Yearly bullish pinbar on sloping 8 EMA, aiming for the 21300 area.

Currently, sure that there isn’t any justification to look for shorts on the Daily and above timeframes. On the contrary, take advantage of every bearish move on the Daily timeframe to look for signs of strength leading to bullish setups right where the market should have revealed weakness.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.