It took only one week to turn the strongest index of the three (Dow, S&P and Nasdaq) into the weakest…Last week, Dow became the weakest. This is usually what happens when the price action doesn’t develop and market reverses back into a range.

The Dow Futures currently do not show any good and reliable setup to either directions, something that usually causes staying inside the previous weekly range for one more week or two.

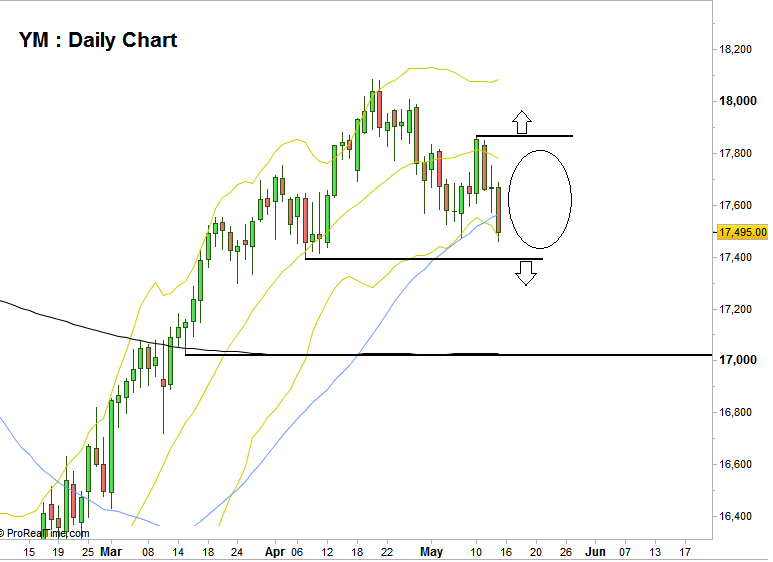

In similar cases where the trend is broken on both sides, reaching back the middle of the range (17670~) is the most likely thing to happen first. Perhaps shorter timeframe track and analysis will provide good opportunities.

If the price does get out of the weekly range considerably, we have to pay attention to the following levels:

As for the bullish side: 17864. Taking out that High, then having a weekly correction that doesn’t go below the 17459 Low and a bullish reversal to take the high again is a very good bullish setup that eventually can take the price to the 18680 area.

As for the bearish side: 17396. Taking out that Low, then a weekly correction up that won’t take the high of 17864 might cause the market to decline much further – to the 17022 level.

YM: The Daily chart with the important levels to pay attention to. Price is most likely going to play inside the range, marked by the oval. (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.