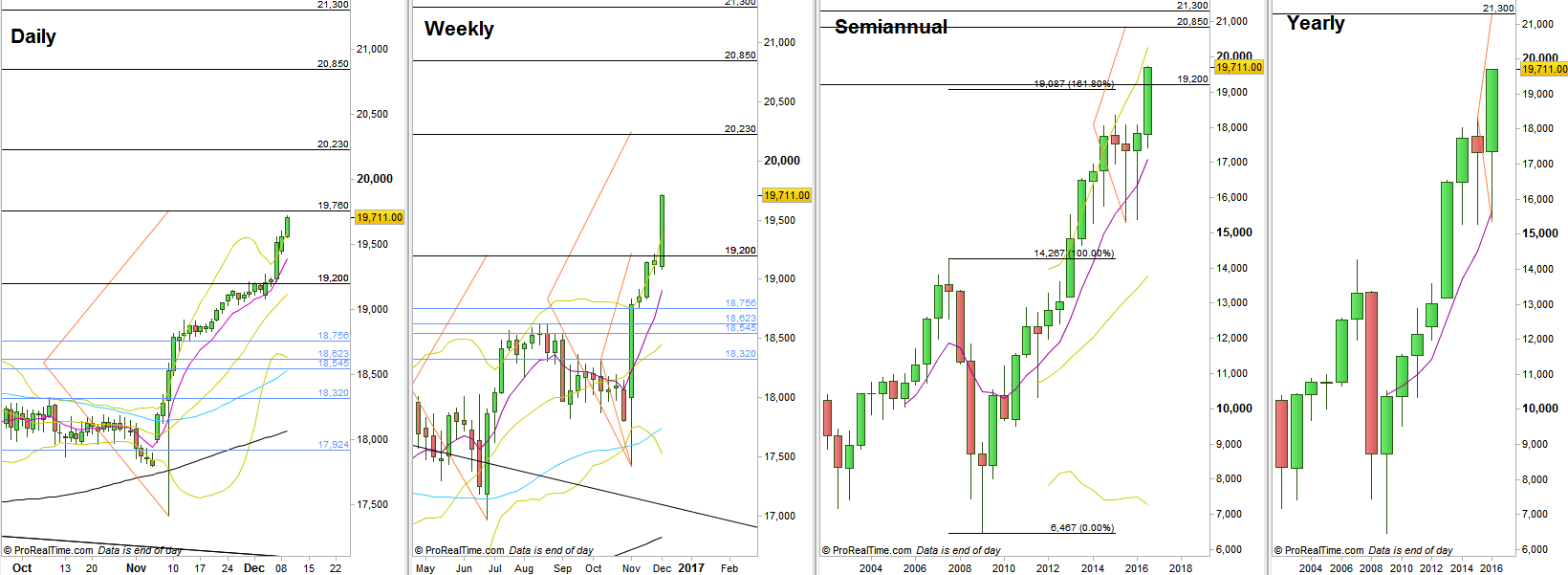

Last review I mentioned that an important target of 19200 has been achieved, and that might bring some considerable covering at list on the Daily, especially when a shortening of the thrust while not touching the upper Bollinger band was seen clearly. But the stock markets over the passing week had their own agenda, and the Dow was no difference (as was with the 19087 target before), renewing the thrust up right at the beginning the passing week, this time penetrating deeply the Daily upper Bollinger band.

The current near target is the target of the big Daily pinbar made after the elections (having a false thrust down and immediate reversal, called a Spring), at 19760. The same Spring has already developed also in the higher timeframes, having a thrust above its High, the Weekly and the Monthly, and currently developing also on the Quarterly.

The target for the Weekly Spring is 20230 and the Monthly Spring points at the 21000.area.

The next important target is the Quarterly bullish pinbar of the 1st Quarter 2016, pointing at the 20020 are as the target, which is the current Quarterly upper Bollinger band level.

Above it we have the Semiannual two successive Bullish pinbars on sloping 8 EMA (a very important and reliable pattern – but the scale needs to be considered as well) targets, pointing at the levels of 20850, and finally, the current Yearly price action calls for reaching the level of 21300 (!)

Interesting to see how it is going to deal with the current strong momentum in a month which is typically a consolidation month (December).

It is obvious that there isn’t any justification to look for shorts on the Daily and above timeframes, and for any current reaction down we should currently assume that it is nothing more than a consolidation process.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.