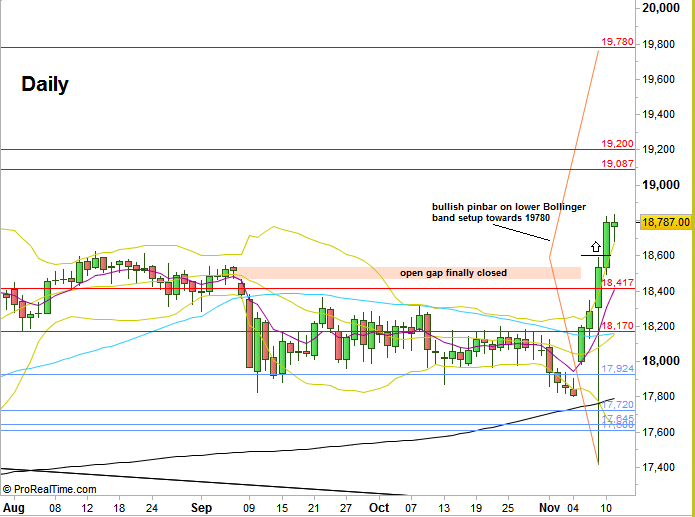

Finally, not only for Wednesday the day after the elections, the whole passing week was very surprising. The Dow, maybe only except for the Russel, was the “star” among all other main indexes, setting a new all time High by the end of the week.

The week has started with a gap up, and a Daily bullish Kicker pattern: After the previous Friday’s bearish bar, came last Monday with a bullish bar and a gap up. This immediately signaled that there is not any point for waiting to a Daily swing bearish signal, at least not before closing the gap and new signs of weakness.

As expected, Wednesday, the day after the elections has been the most volatile day throughout the whole year, with a huge false thrust down, in the direction of the bearish setup mentioned before. But the thrust down didn’t last much and didn’t reach the down trend line mentioned couple of times in the previous reviews.

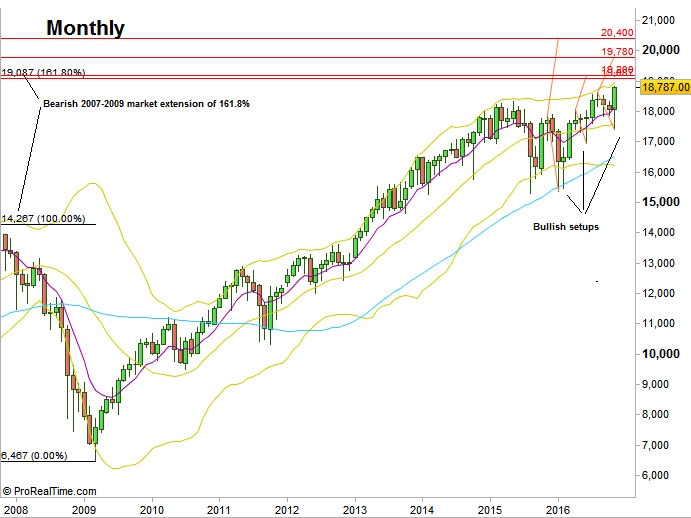

Once the thrust down turned into a false thrust, and the High of October Monthly inside bar was taken out, this was a signal to reach the same magnitude to the upside, approximately the level of 19200 (see the Monthly chart).

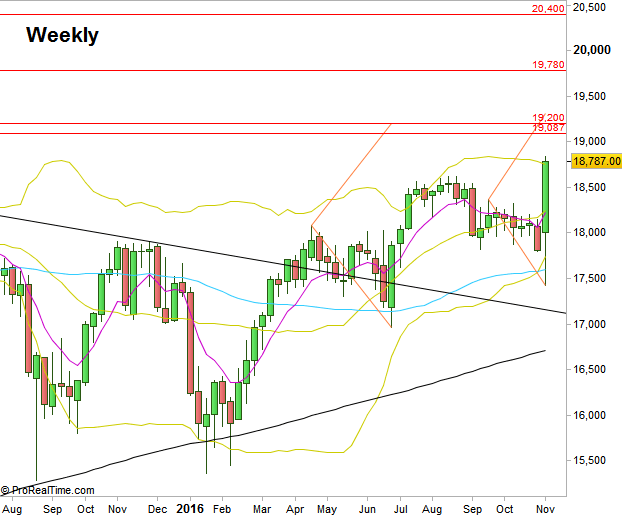

This should remind us the previous bullish setup pointed towards 19200 as well. (see the Weekly chart).

The most important resistance above is the 19080-19100 level area, (19087 is the 161.8% extension of the bearish market of 2007-2009.

Dow Futures, Daily chart (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.