The passing week continued the weakness over the last 3 weeks, and eventually closed in the middle.

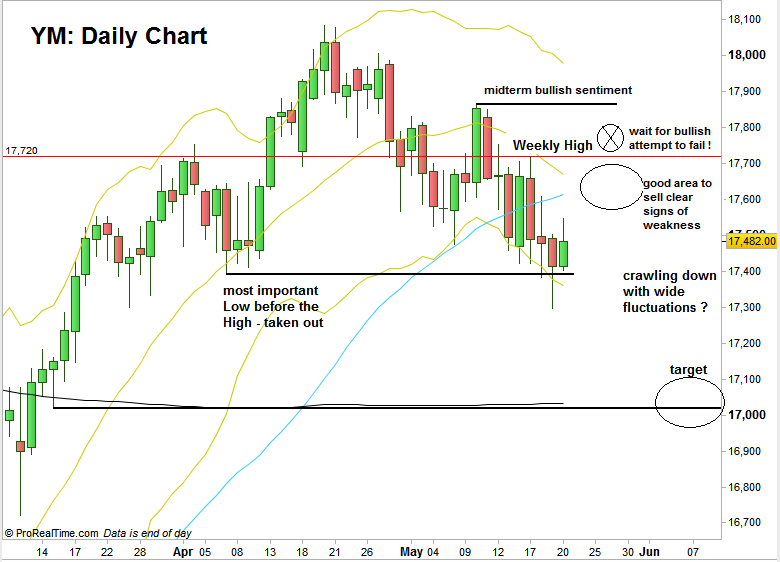

The price did manage to take out the major Low before the High at 17396, so there should be a bearish sentiment for the mid term.

There is currently a bearish setup to the 17000-17100 area with a stop loss above 17864. The setup is not that strong and clear, and we are currently in the middle of the range, so there isn’t much to do as of a daily swing at the beginning of the week.

Any rally back to test the High of the passing week should be watched for new signs of weakness and a good bearish signal on the shorter timeframe – as long as the Weekly High remains respected (i.e. not taken out).

If the Weekly High is taken out, then it is wise to wait for the bullish setup to fail, rather than jumping on the first sign of weakness in order to go short.

As mentioned in the last review, going above the 17864 is a bullish sign for the midterm, and should be addressed if/when.

The potential bearish behavior is more likely to crawl down with lots of wide fluctuations rather than a sharp move down. This behavior is also mentioned as well in the SP Futures Weekly review.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.