U.S. stock futures are pointing higher in pre-market trading for Thursday, June 30. The Dow Futures are up 48.00 points to 17672.0. The S&P 500 Futures are up 5.50 points to 2072.25. The Nasdaq Futures are higher at 4371.25 with a gain of 8.50 points. The Russell Futures are showing a gain of 3.30 points at 1132.4.

In overnight trading in the Eastern Hemisphere, stocks were mostly higher. Hong Kong’s Hang Seng Index was higher at 20794.37 for a gain of 358.25 points or 1.75 percent. Japan’s Nikkei 225 was higher at 15575.92 for a gain of 9.09 points or 0.06 percent. China’s Shanghai Composite was lower at 2929.61 for a loss of -1.99 points or -0.07 percent. India’s S&P BSE Sensex was higher at 26999.72 for a gain of 259.33 points or 0.97 percent. In Europe, stocks were higher. The FTSE 100 closed at 6382.24 for a gain of 22.18 points or 0.35 percent. Germany’s DAX was higher at 9638.51 for a gain of 26.24 points or 0.27 percent. France’s CAC 40 was higher at 4226.68 for a gain of 31.36 points or 0.75 percent. The Stoxx Europe 600 was higher at 327.29 for a gain of 0.80 points or 0.25 percent.

Thursday’s Factors and Events

On Thursday markets will be watching the jobless claims report as the direction for the labor market is still a leading indicator for the Federal Reserve’s monetary policy decisions. The Jobless Claims report will be released at 8:30 AM EST. Also on the calendar for Thursday is the Chicago PMI, the Bloomberg Consumer Comfort Index, the Fed Balance Sheet and the Money Supply. At 2:00 PM EST James Bullard, St. Louis Federal Reserve Bank President, will be giving a speech in London at a meeting for the Society of Business Economists.

Stocks trading actively in pre-market trading include McCormick & Company, Bank of America, Goldman Sachs, Alcoa, Qualcomm, Northern Trust, Perrigo Company PLC, EMC Corp. and Apple.

Earnings reports on the calendar for the day include the following: ConAgra Foods, Inc., Darden Restaurants, Inc., Lindsay Corporation, McCormick & Company, Inc., Paychex, Inc., Schnitzer Steel Industries, Inc., Constellation Brands, Inc. and Franklin Covey Company.

In the U.K. stocks have been improving and on the calendar for Thursday is a speech from Bank of England Governor, Mark Carney.

Wednesday’s Activity

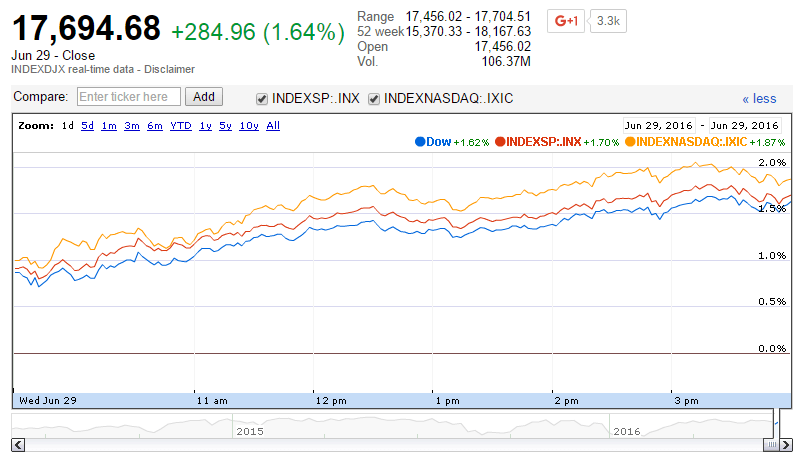

In the U.S., the leading indexes were higher on Wednesday. The Dow Jones Industrial Average was higher at 17694.68 for a gain of 284.96 points or 1.64 percent. The S&P 500 was also higher, closing at 2070.77 for a gain of 34.68 points or 1.70 percent. The Nasdaq composite closed higher at 4779.25 for a gain of 87.38 points or 1.86 percent.

Source: DJIA, S&P 500 and Nasdaq Composite. Google Finance.

Other notable index closes in the U.S. included the small-cap Russell 2000, closing higher at 1131.62 for a gain of 24.32 points or 2.20 percent; the S&P 600 closing at 693.87 for a gain of 14.03 points or 2.06 percent; the S&P 400 Mid-Cap Index closing at 1468.20 for a gain of 25.70 points or 1.78 percent; the Russell 3000 closing at 1219.61 for a gain of 21.16 points or 1.77 percent; and the Dow Jones U.S. Select Dividend Index closing at 600.15 for a gain of 8.96 point or 1.52 percent.