U.S. stock futures are higher in pre-market trading for Friday, July 8. The Dow Futures are at 17841.0 for a gain of 23.00 points. The S&P 500 Futures are at 2095.25 for a gain of 3.25 points. The Nasdaq Futures are at 4456.0 for a gain of 3.75 points. The Russell Futures are at 1150.6 for a gain of 4.50 points.

In overnight trading in the Eastern Hemisphere, stocks were lower in Asia. Japan’s Nikkei 225 was lower at 15106.98 for a loss of -169.26 points or -1.11 percent. Hong Kong’s Hang Seng Index was lower at 20564.17 for a loss of -142.75 points or -0.69 percent. China’s Shanghai Composite was lower at 2988.09 for a loss of -28.75 points or -0.95 percent. India’s S&P BSE Sensex was lower at 27126.90 for a loss of -74.59 points or -0.27 percent. In Europe, stock trading was mixed. The FTSE 100 was lower at 6524.06 for a loss of -9.73 points or -0.15 percent. Germany’s DAX was higher at 9499.51 for a gain of 80.73 points or 0.86 percent. France’s CAC 40 was higher at 4144.02 for a gain of 26.17 points or 0.64 percent. The Stoxx Europe 600 was higher at 323.34 for a gain of 1.22 points or 0.38 percent.

Friday’s Factors and Events

The main economic report on the calendar for Friday is the Bureau of Labor Statistics’ Employment Situation report. Economists are expecting the report to show an increase of 180,000 jobs with the unemployment rate rising to 4.8 percent. Also being reported on Friday is the Baker-Hughes Rig Count and the Consumer Credit report. The Baker-Hughes Rig Count reported 507 rigs in the previous week. Consumer Credit is expected to rise for the month with a consensus increase of $16 billion.

Stocks trading actively in pre-market trading include the following: Transocean, Pepsi, Facebook, Microsoft, Visa, General Electric and NVIDIA.

Stocks are trading higher in the pre-market as investors anticipate an improved jobs report from June. Other factors of the report will also be closely considered such as wages and hours worked.

Thursday’s Activity

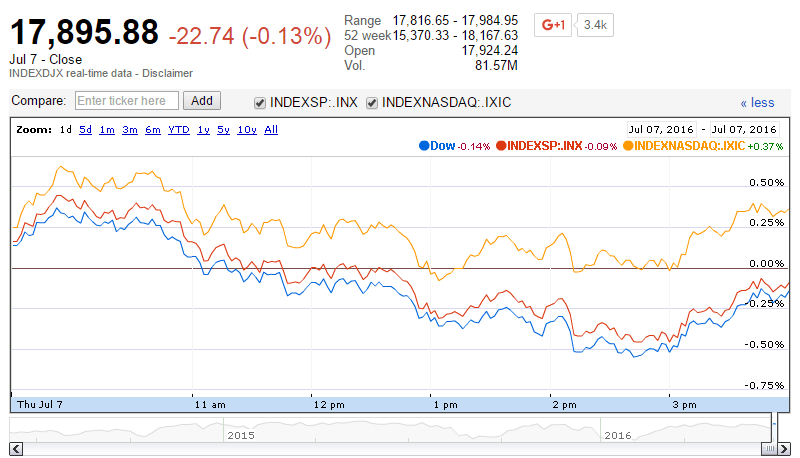

On Thursday, stock trading was mixed and markets appear poised for a breakout session if the jobs data has improved. For the day on Thursday, the Dow Jones Industrial Average closed lower at 17895.88 for a loss of -22.74 points or -0.13 percent. The S&P 500 was also down, closing at 2097.90 for a loss of -1.83 points or -0.09 percent. The Nasdaq Composite closed higher at 4876.81 for a gain of 17.65 points or 0.36 percent.

Source: DJIA, S&P 500 and Nasdaq Composite. Google Finance.

Other notable index closes included the small-cap Russell 2000, higher at 1149.76 for a gain of 2.42 points or 0.21 percent; the S&P 600 closing at 705.56 for a gain of 1.25 points or 0.18 percent; the S&P 400 Mid-Cap Index closing at 1492.60 for a gain of 2.58 points or 0.17 percent; the S&P 100 closing at 929.34 for a loss of -0.50 points or -0.05 percent; the Russell 3000 closing at 1236.12 for a loss of -0.35 points or -0.03 percent; the Russell 1000 closing at 1161.24 for a loss of -0.55 points or -0.05 percent; and the Dow Jones U.S. Select Dividend Index closing at 607.79 for a loss of -3.99 points or -0.65 percent.