The passing week ended as a small range correction bar, the 3rd Weekly bar to penetrate the Weekly upper Bollinger band, meaning that the bullish momentum is still high, and Daily bearish setups are not recommended, such as the Daily bearish setup mentioned in the last review that hasn’t reached its target.

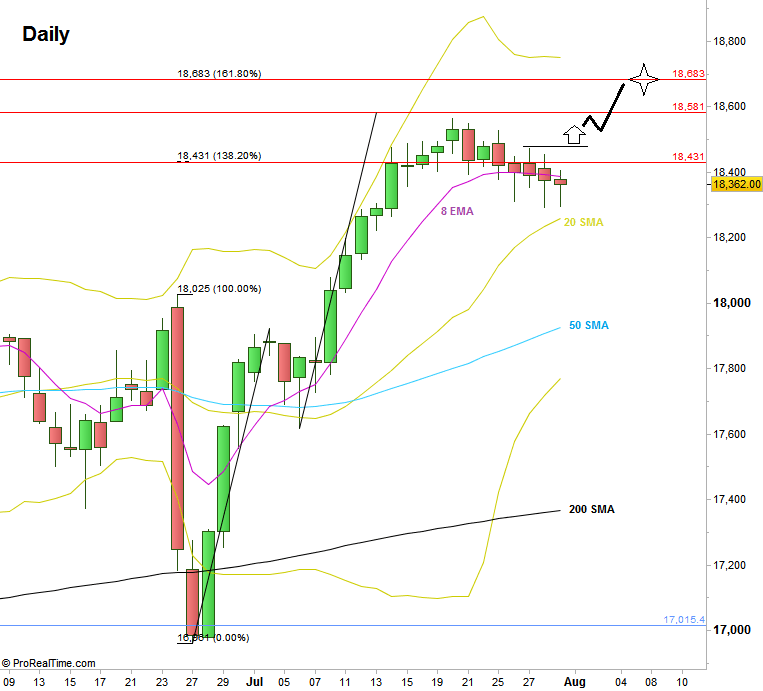

The Daily chart shows some weakness as the last 4 Daily bars have closed below the 8 EMA short term sentiment line.

However, taking out the High of last Wednesday at 18471 is a good indication that the Weekly correction is probably over, and there are good chances to reach the 161.8% extension level of the Brexit reaction. At 18683.

Pay attention that the Monthly bar that started very bullishly closed considerably below its High, and hasn’t reached the upper Bollinger band – an important sign of weakness.

Currently there isn’t any change as for the setups mentioned in the last review. A bearish Daily setup to reach the 18270 area, and is less likely to succeed because of the big Weekly bullish momentum, and the Weekly bullish setup to reach the 19200 level area, but the current stop for this move is below June’s Low at 16961.

Dow Futures, Daily chart (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.