The Month of November has finally printed a strong bullish bar, engulfing pattern and a pinbar shape on sloping 8 EMA, penetrating deeply the upper Monthly Bollinger band, a very bullish picture for the mid term. However, for that important formation to develop, a thrust up above the High is needed to be set in order confirm it.

Like the SP500, the Dow Monthly High was recorded on the last day of the month, but unlike the SP500, it wasn’t being recorded in an upthrust formation, but as a bullish move up. The Low of that day hasn’t been taken out yet, and the first two trading days of December were inside Daily bars, and that includes also the most noisy report, the NFP…

Currently the market doesn’t generate any good indication for a bullish or bearish move.

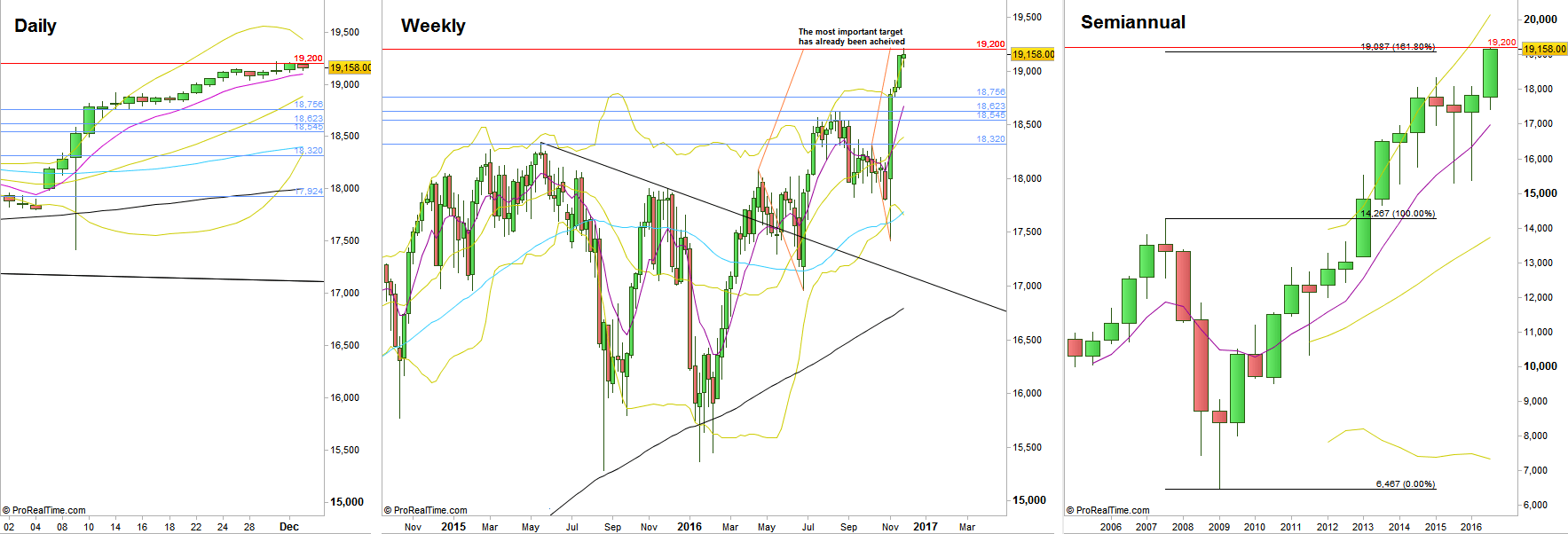

The Daily, although keeping away from the upper Bollinger band for the last 13 bars, still doesn’t show any significant supply. All the late Daily bars are in a clear uptrend, not even touching the 8 EMA short term sentiment line plodding along below, a clear sign of strength.

The most important target at 19200, mentioned throughout most of the last reviews has been finally achieved. That might be a cause for a considerable pullback at least on the Daily. There isn’t any bearish signal on the Daily, and besides , that way down can start first with a false thrust up / an upthrust.

The Dow Futures, Daily, Weekly and Semiannual charts (At the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.