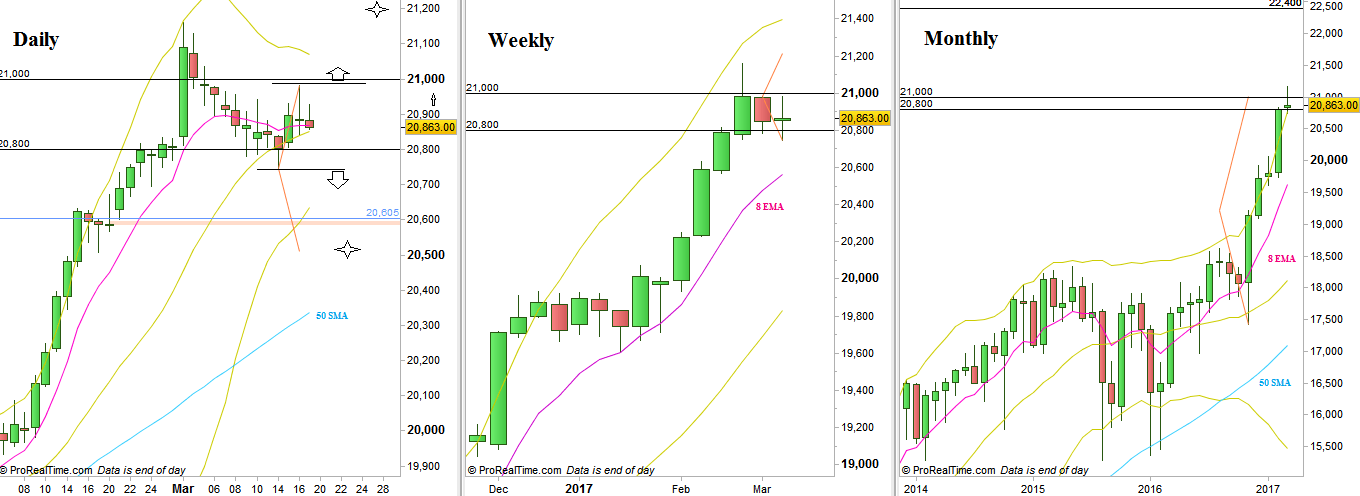

The passing week ended as a small range Weekly bar, closing at the middle. The importance of this bar is the thrust sown made below the Weekly Low (the previous Weekly bar was an inside bar).

The fact that the price took out the Weekly Low brings much more validity in case the new Weekly High is going to be taken out. This wouldn’t have been the same had the Weekly bar printed as an inside bar.

So, taking out the Weekly High is a bullish setup to reach a new all time High, at the area of level 21200.

On the other hand, taking out the (new) Weekly Low once again is a bearish setup to reach 20505. In this case, since there had been a bearish setup prior to this one, (by taking out the Low at last Tuesday) – that has already failed – taking out the Stops above (above Friday, March 10th), – there is more validity for this setup to work. But, again, this comes after a tangible strength, and a strong rally (mainly at February), that I would be more cautious before entering this position.

.

Dow Futures, Daily, Weekly and Monthly charts (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.