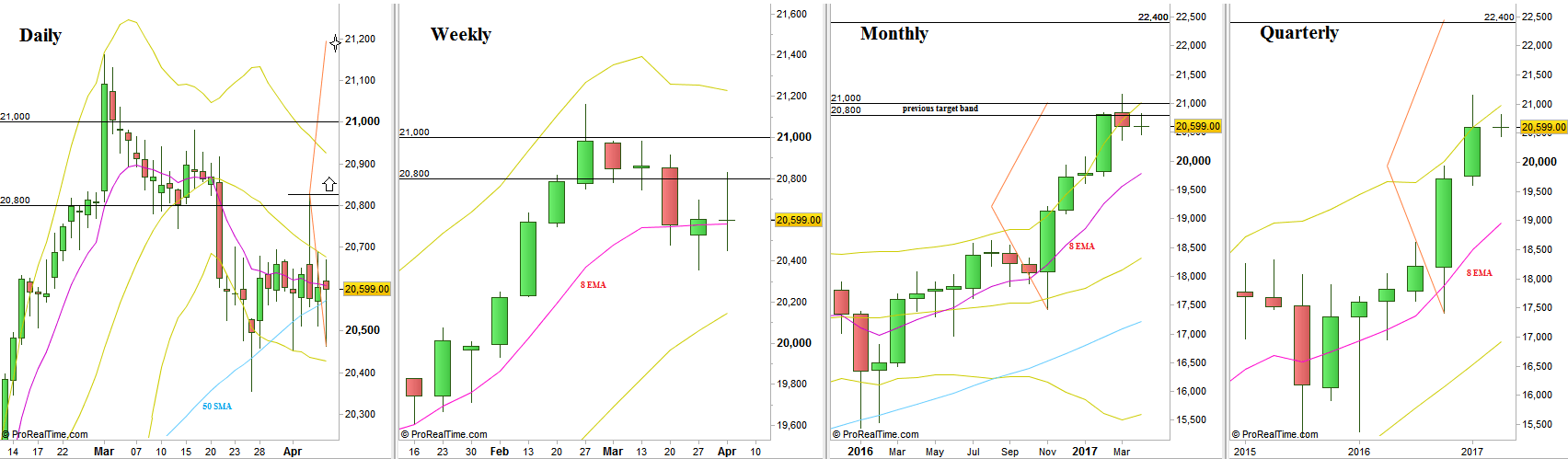

The passing week printed a HH HL Weekly bar that though didn’t close on its High, still closed above the 8 EMA short term sentiment line. This is a clear sign of strength. The Daily Swing price action was mostly sideways action, caring to close each bar above the Daily 50 SMA, another sign of strength.

Taking out the Weekly High at 20828 is a bullish trigger to reach the upper Monthly range for a new all time High, 21190, very closed to the Weekly upper Bollinger band. The Stop level for this trigger is below last Friday’s Low, at 20462. I would give that signal many chances (if the price does trigger the Weekly High).

The price action that we have seen for the last five weeks is a typical behavior of being too stretched in the higher timeframe (in this case the Monthly), causing the price to stay in a range, waiting for the fast moving averages like the 8 EMA to approach closely to the price. Notice how the price avoids extreme situations like reaching the Bollinger bands. The thrust up traders were used to while experiencing the big momentum up was replaced by rather calm sideways action.

The next major target is quite far at the moment, the target of the year 2016 last Quarter’s Spring bar (caused by the US elections) that points towards 22500. It would be very rare to see the price action reaches those levels rapidly without being in a Monthly correction first, especially if we currently are at a level of many setup targets that have been reached lately (described on the last reviews).

Dow Futures, various timeframes (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.