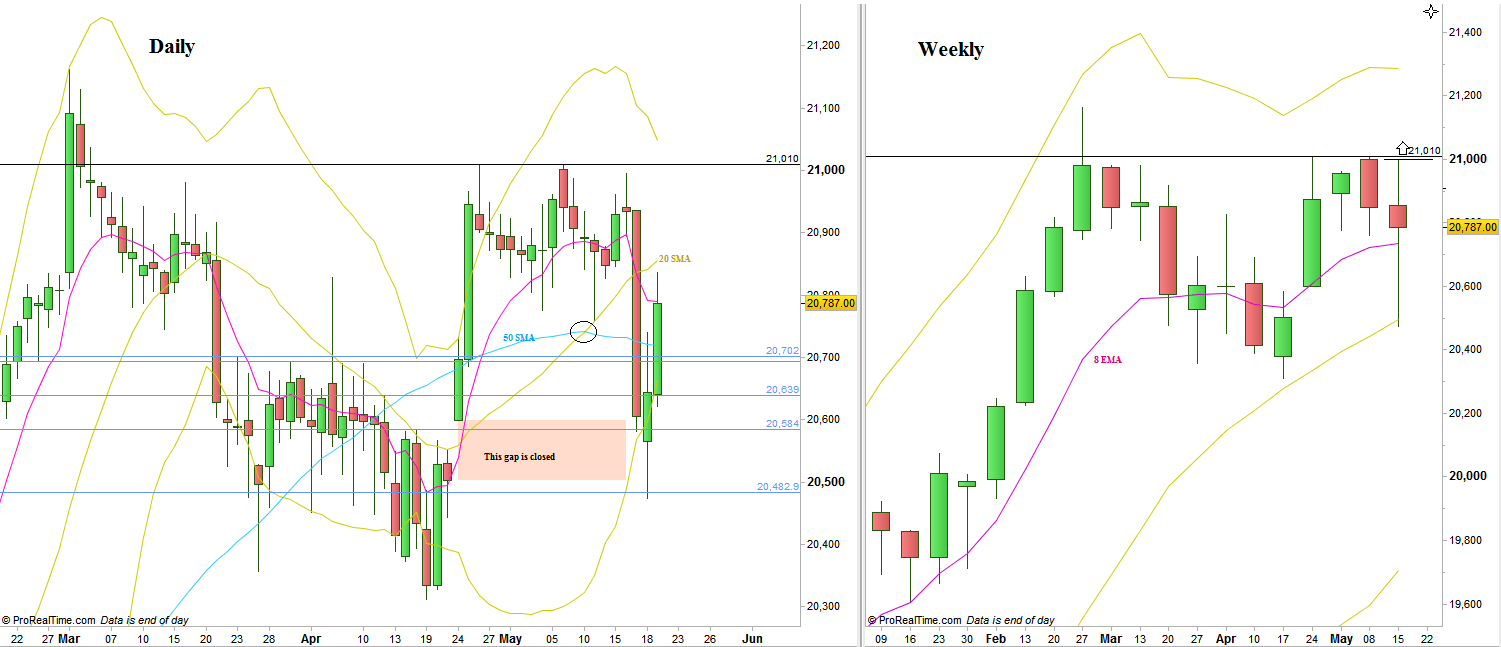

The passing week was the most volatile week lately, mainly thanks to the last Wednesday, as prices declined sharply towards strong support, where the last thrust down took place at last Thursday just to close the open gap below completely and to reverse back inside the previous range.

The Weekly bar printed finally a sort of bullish Pinbar on sloping Weekly 8 EMA as well as on sloping Weekly 20 SMA, closing above the Weekly 8 EMA, a sign of strength.

Taking out the Weekly High is going to take out by most chances the Monthly High, indicating that the current Monthly correction is most likely at its end. The target in this case is at 21550.

However, the current price action gives much more chances to see the coming week trading inside the range of last week.

Look closely at any retracement on the Daily, to see if it is having a support on the Daily 50 SMA. In case it is, additional signs of strength can drive the market back into the roots of last Wednesday, at 20940.

The Dow is going to be bearish only if the price takes out the Weekly Swing Low at 20311. At the moment, I would give much less chances for such a scenario.

Dow Futures: Daily and Weekly charts (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.