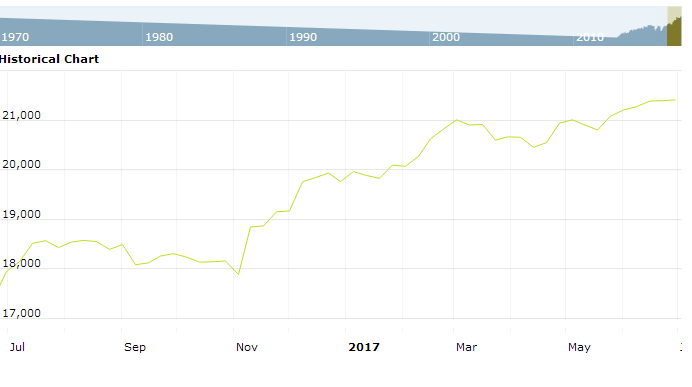

U.S. stock futures are lower in pre-market trading for Tuesday, June 27.The Dow Futures are trading at 21,348.50 with a loss of -0.09% percent or -19.50 point. The S&P 500 Futures are trading at 2,433.50 with a loss of -0.10% percent or -2.50 point.The Nasdaq Futures are trading at 5,753.12 with a loss of -0.43% percent or -25.13 point.

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 are trading at 20,225.09 for up with +0.36% percent or +71.74 point. Hong Kong’s Hang Seng are trading at 25,836.69 with a loss of –0.14% percent or –35.2point. China’s Shanghai Composite are trading at 3,188.92 for up with +0.11% percent or +3.48 point. India’s S&P BSE Sensex are trading at 31,006.08 with a loss of –0.42% percent or –131.97 point at 12:26 PM . In Europe, the FTSE 100 are trading at 7,432.63 with a loss of –0.19% percent or –14.17 point. Germany’s DAX are trading at 12,707.65 with a loss of –0.49% percent or –64.28 point. France’s CAC 40 are trading at 5,259.52 with a loss of –0.68% percent or –36.23 point. The Stoxx Europe 600 are trading at 386.80 with a loss of -0.60% percent or -2.34 point.

Tuesday’s Factors and Events

The market is keenly waiting for Fed Chair Janet Yellen’s discussion on global economic issues this afternoon. The 20-city S&P Corelogic Case-Shiller home price index is another major focus of the day. Asian stocks closed mixed, while European shares are trading in the red. Early signs from U.S. Futures Index suggest that Wall Street might open lower.

As of 6.45 am ET, the Dow futures were slipping 14 points, the S&P 500 futures were shedding 1.50 points and the Nasdaq 100 futures were slipping 21 points.

U.S. stocks closed mixed on Monday. The Nasdaq fell 18.10 points or 0.3 percent to 6,247.15, the Dow edged up 14.79 points or 0.1 percent to 21,409.55 and the S&P 500 inched up 0.77 points or less than a tenth of a percent to 2,493.07.

On the economic front, the Redbook data, a weekly measure of comparable store sales at chain stores, discounters, and department stores, will be revealed at 8.55 am ET. The prior week stores sales were up 2.8 percent.

The S&P Corelogic Case-Shiller home price index for April that tracks monthly changes in the value of residential real estate in 20 metropolitan regions across the U.S. will be released at 9.00 am ET. The economists are looking for consensus of growth of 0.6 percent.

Monday’s Activity

U.S. market indexes were mixed on Monday. For the day the Dow Jones Industrial Average closed at 21,409.55 for up with +0.07% percent or +14.79 point. The S&P 500 closed at 2,439.07 for up with +0.03% percent or +0.77 point. The Nasdaq Composite closed at 6,247.15 with a loss of –0.46% percent or –18.10 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,415.95 for up with +0.11% percent or +1.51 point; the S&P 600 Small-Cap Index closed at 854.44 for up with +0.15% percent or +1.27 point; the S&P 400 Mid-Cap Index closed at 1,750.75 for up with +0.39% percent or +6.80 point; the S&P 100 Index closed at 1,075.26 with a loss of –0.02% percent or –0.17 point; the Russell 3000 Index closed at 1,445.52 for up with +0.07% percent or +0.97 point; the Russell 1000 Index closed at 1,352.22 for up with +0.06% percent or +0.84 point; and the Dow Jones U.S. Select Dividend Index closed at 21,409.55 for up with +0.07% percent or +14.79 point.