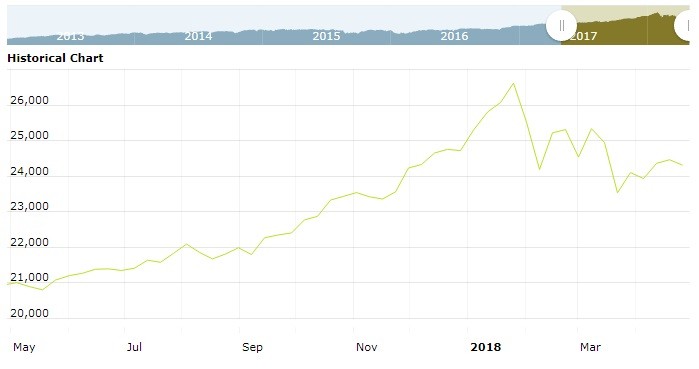

U.S. stock futures higher in pre-market trading for Thursday, May 03.The Dow Futures is trading at 23,870.00 up with +45.00 percent or +45.00 point.The S&P 500 Futures is trading at 2,632.50 up with +0.19% percent or +5.00 point. The Nasdaq Futures is trading at 6,644.50 up with +0.17% percent or +11.00 point.

In overnight trading in the Eastern Hemisphere,Japan’s Nikkei 225 is trading at 22,472.78 with a loss of -0.16% percent or -35.25 point. Hong Kong’s Hang Seng is trading at 30,329.31 with a loss of -1.26% percent or -388.52 point. China’s Shanghai Composite is trading at 3,100.86 up with +0.64% percent or +19.68 point. India’s BSE Sensex is trading at 35,094.74 with a loss of -0.23% percent or -82.50 point at 12:15 PM.The FTSE 100 is trading at 7,541.62 with a loss of -0.012% percent or -0.93 point. Germany’s DAX is trading at 12,777.63 with a loss of -0.18% percent or -22.74 point. France’s CAC 40 is trading at 5,515.16 with a loss of -0.25% percent or -14.06 point. The Stoxx Europe 600 is trading at 386.47 with a loss of -0.25% percent or -0.95 point.

Thursday’s Factors and Events

Wednesday’s Activity

U.S. market were lower on Wednesday.For the day the Dow is trading at 23,924.98 with a loss of -0.72% percent or -174.07 point. The S&P 500 is trading at 2,635.67 with a loss of -0.72% percent or -19.13 point. The Nasdaq Composite is trading at 7,100.90 with a loss of -0.42% percent or -29.81 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,554.91 up with +0.29% percent or +4.57 point; the S&P 600 Small-Cap Index closed at 953.41 up with +0.16% percent or +1.53 point; the S&P 400 Mid-Cap Index closed at 1,875.83 with a loss of -0.20% percent or -3.74 point; the S&P 100 Index closed at 1,156.64 with a loss of -0.67% percent or -7.76 point; the Russell 3000 Index closed at 1,564.57 with a loss of -0.61% percent or -9.61 point; the Russell 1000 Index closed at 1,461.84 with a loss of -0.69% percent or -10.10 point;

Michael Shaoul, chairman and CEO of Marketfield Asset Management, also pointed out the central bank used the word “symmetric” to describe its inflation target. “We imagine that its use indicates a willingness to allow inflation to track higher than 2 percent for a period to compensate for the long time that it stayed below this level,” he said

The Fed kept interest rates unchanged, as was largely expected. The central bank’s policymaking committee also noted that “overall inflation and inflation for items other than food and energy have moved close to 2 percent.” That was an upgrade from the March meeting in which the FOMC said the indicators “have continued to run below 2 percent.”