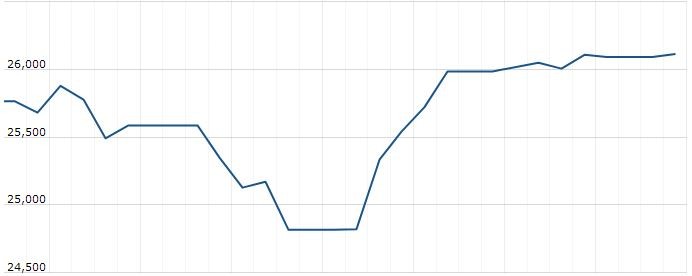

U.S. stock futures mixed in pre-market trading for , June 19 The Dow Futures is trading at 26,506.50 up with +0.01% percent or +2.50 point. The S&P 500 Futures is trading at 2,925.88 with a loss of -0.01% percent or -0.37 point.The Nasdaq Futures is trading at 7,674.88 up with +0.02% percent or +1.38 point.

In overnight trading in the Eastern Hemisphere, In other parts of world, Japan’s Nikkei 225 is trading at 21,333.87 up with +1.72% percent or +361.16 point. Hong Kong’s Hang Seng is trading at 28,141.16 up with +2.34% percent or +642.39 point. China’s Shanghai Composite is trading at 2,917.80 up with +0.96% percent or +27.65 point. India’s BSE Sensex is trading at 39,187.76 up with +0.36% percent or +141.42 point at 12:15 PM.The FTSE 100 is trading at 7,427.54 with a loss of -0.21% percent or -15.50 point. Germany’s DAX is trading at 12,332.80 up with +0.0085% percent or +1.05 point. France’s CAC 40 is trading at 5,512.33 up with +0.047% percent or +2.61 point. The Stoxx Europe 600 is trading at 384.61 with a loss of -0.04% percent or –0.23 point.

Wednesday’s Factors and Events

The Fed is scheduled to deliver its decision at 2 p.m. ET. The central bank is not expected to make any changes in terms of monetary policy, but investors will look for clues on whether the Fed will cut rates later this year. Fed Chair Jerome Powell will hold a news conference after the announcement.

Traders are pricing in easier monetary policy as soon as July. They are also betting on rate cuts coming in September and December, according to the CME Group’s FedWatch tool.

“The bottom line with today’s FOMC statement and Powell press conference is whether they confirm the markets expectations for a rate cut (currently at 82%) in July or will we hear more about patience that tries to shift those odds closer to 50%, thus giving the Fed more independence and optionality instead of their current position of being cornered and bullied by the market,” Peter Boockvar, chief investment officer at Bleakley Advisory Group, said in a note.

Tuesday Activity

For the day the Dow is trading at 26,465.54 up with +1.35% percent or +353.01 point. The S&P 500 is trading at 2,917.75 up with +0.97% percent or +28.08 point. The Nasdaq Composite is trading at 7,953.88 up with +1.39% percent or +108.86 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,550.23 up with +1.14% percent or +17.48 point; the S&P 600 Small-Cap Index closed at 936.03 up with +1.30% percent or +12.02 point; the S&P 400 Mid-Cap Index closed at 1,921.35 up with +1.15% percent or +21.79 point; the S&P 100 Index closed at 1,289.69 up with +0.97% percent or +12.34 point; the Russell 3000 Index closed at 1,716.47 up with +1.00% percent or +16.92 point; the Russell 1000 Index closed at 1,615.70 up with +0.98% or +15.76 point.