U.S. stock futures higher in pre-market trading for , August 23 The Dow Futures is trading at 26,267.50 up with +0.16% percent or +42.50 point. The S&P 500 Futures is trading at 2,927.38 up with +0.18% percent or +5.13 point.The Nasdaq Futures is trading at 7,733.88 up with +0.29% percent or +22.63 point.

In overnight trading in the Eastern Hemisphere, In other parts of world, Japan’s Nikkei 225 is trading at 20,710.91 up with +0.40% percent or +82.90point. Hong Kong’s Hang Seng is trading at 26,188.50 up with +0.54% percent or +139.78 point. China’s Shanghai Composite is trading at 2,897.43 up with +0.49% percent or +13.99 point. India’s BSE Sensex is trading at 36,612.10 up with +0.38% percent or +139.17 point at 12:15 PM.The FTSE 100 is trading at 7,170.59 up with +0.59% percent or +42.41 point. Germany’s DAX is trading at 11,772.45 up with +0.22% percent or +25.41 point. France’s CAC 40 is trading at 5,406.59 up with +0.34% percent or +18.35 point. The Stoxx Europe 600 is trading at 375.87 up with +0.42% percent or +1.54 point.

Friday’s Factors and Events

Market participants will closely monitor Powell’s speech at the Jackson Hole symposium later in the session, hoping for clarity on monetary policy. It comes after minutes from the U.S. central bank’s July meeting tempered hopes of aggressive rate cuts over the coming months.

The Fed’s top official is scheduled to address an audience of policymakers and economists at around 10:00 a.m. ET.

As of Friday morning, Fed funds futures were pricing a likelihood of almost 90% for a 25 basis point rate cut at the September meeting, and between one or two further quarter-point rate cuts between then and the end of the year.

Meanwhile, the widely watched 2-year/10-year U.S. yield curve — often monitored as precursor for recession — briefly moved back into inversion on Thursday. It was the third time in two weeks that the bond market yield had flashed recession red lights

Thursday Activity

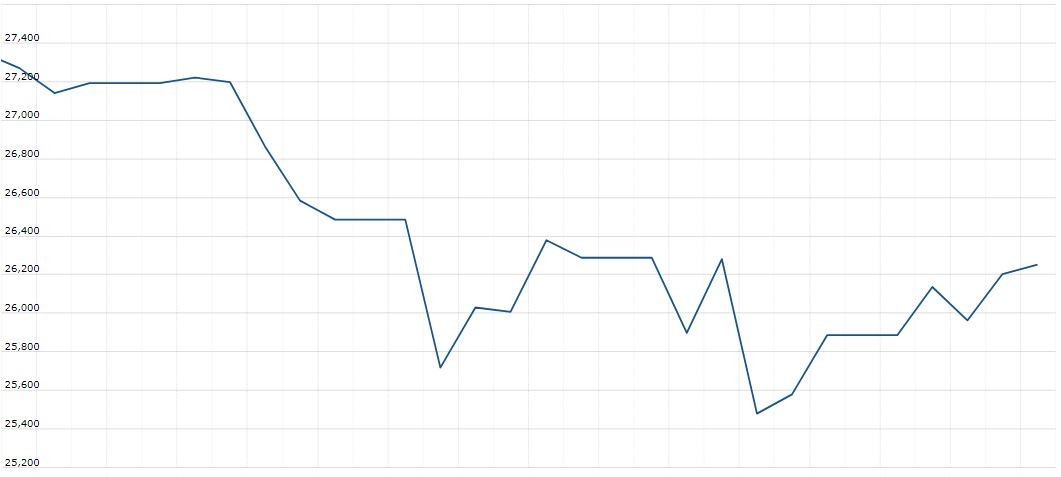

For the day the Dow is trading at 26,252.24 up with +0.19% percent or +49.51 point. The S&P 500 is trading at 2,922.95 with a loss of –0.051% percent or –1.48 point. The Nasdaq Composite is trading at 7,991.39 with a loss of –0.36% percent or –28.82 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,506.00 with a loss of –0.25% percent or -3.85 point; the S&P 600 Small-Cap Index closed at 925.35 with a loss of –0.30% percent or -2.76 point; the S&P 400 Mid-Cap Index closed at 1,888.46 up with +0.085% percent or +1.60 point; the S&P 100 Index closed at 1,291.31 with a loss of -0.060% percent or -0.78 point; the Russell 3000 Index closed at 1,715.41 with a loss of –0.067% percent or-1.16 point; the Russell 1000 Index closed at 1,617.94 with a loss of –0.054% or -0.88 point.