U.S. stock futures are lower in pre-market trading for Tuesday, July 5. The stock futures are pointing lower in the first trading day of the week after the broad market was closed on Monday for the Fourth of July holiday. The Dow Futures are down -76.00 points to 17790.0. The S&P 500 Futures are down -10.25 points to 2086.0. The Nasdaq Futures are down -20.00 points to 4413.25. The Russell Futures are down -5.30 points to 1148.9.

In overnight trading in the Eastern Hemisphere stocks were mostly lower. The Shanghai Composite edged slightly higher to gain 17.79 points or 0.60 percent at 3006.39. Japan’s Nikkei 225 was lower at 15669.33 for a loss of -106.47 points or -0.67 percent. Hong Kong’s Hang Seng Index was lower at 20750.72 for a loss of -308.48 or -1.46 percent. India’s S&P BSE Sensex was lower at 27166.87 for a loss of -111.89 or -0.41 percent and the NSE Nifty in India was also lower at 8,335.95 for a loss of -34.75 points or -0.42 percent.

In Europe, the FTSE 100 was higher at 6557.70 for a gain of 35.44 points or 0.54 percent. Germany’s DAX was lower at 9576.29 for a loss of -132.80 points or -1.37 percent. France’s CAC 40 was lower at 4181.32 for a loss of -53.54 points or -1.26 percent. The Stoxx Europe 600 was lower at 326.09 for a loss of -3.69 points or -1.12 percent.

Tuesday’s Factors and Events

On the economic calendar for Tuesday are a number of reports influencing the economy and the day’s trading. At 8:30 AM EST the Gallup US ECI report will be released. At 10:00 AM EST Factory Orders will be released. At 12:30 PM EST the TD Ameritrade IMX report will be released. At 1:00 PM EST the Gallup US Consumer Spending Measure will be released. At 2:30 PM EST Fed official William Dudley will speak at a Binghampton Chamber of Conference roundtable discussion in Binghampton, New York. A few Treasury auctions are also scheduled for the day, including the 4-week Treasury bill auction, the 3-Month Treasury bill auction and the 6-Month Treasury bill auction.

Stocks trading actively in pre-market trading include the following: Newmont Mining, American Express, Leucadia National, Berkshire Hathaway, Yahoo, Illumina, Skyworks Solutions, Oracle and Fifth Third Bancorp.

Stocks to watch with earnings reports on Tuesday and Wednesday include the following: International Speedway Corporation, The Greenbrier Companies, Inc., MSC Industrial Direct Co. Inc., SuperCom, Ltd., Walgreens Boots Alliance, Inc. and Cogeco Communications Inc.

Brexit reform and a potential recession seem to be the key factors weighing on market trading for the day. A leading U.K. construction industry report showed construction sentiment downtrodden as demand in the U.K. could fall. European banks are also lower led by losses from Royal Bank of Scotland and Barclays.

Friday’s Activity

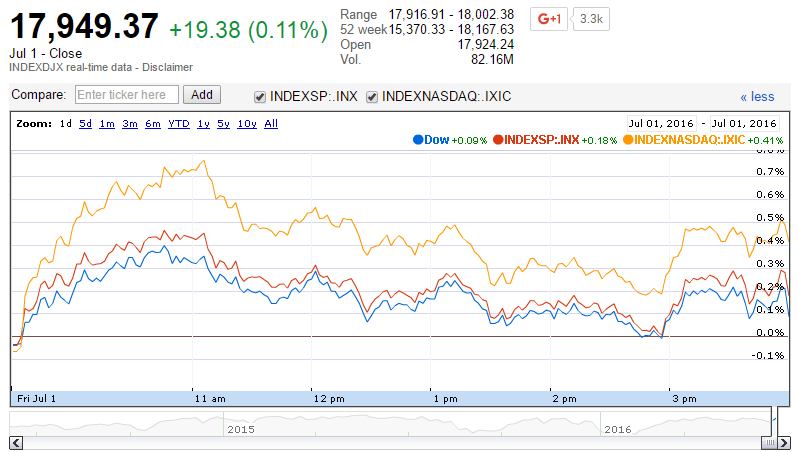

Stocks will open from where they closed on Friday which was mostly higher for the day. For the day the Dow Jones Industrial Average closed at 17949.37 for a gain of 19.38 points or 0.11 percent. The S&P 500 was also higher, closing at 2102.95 for a gain of 4.09 points or 0.19 percent. The Nasdaq Composite closed higher at 4862.57 for a gain of 19.89 points or 0.41 percent.

Source: DJIA, S&P 500 and Nasdaq Composite. Google Finance.

Other notable index closes included the small-cap Russell 2000, higher at 1156.77 for a gain of 4.84 points or 0.42 percent. The S&P 600 closing at 710.17 for a gain of 1.81 points or 0.26 percent; the S&P 400 Mid-Cap Index which closed at 1500.20 for a gain of 3.70 points or 0.25 percent; the S&P 100 closing at 929.68 for a gain of 1.55 points or 0.17 percent; the Russell 3000 which closed at 1239.52 for a gain of 2.90 points or 0.23 percent; the Russell 1000 which closed at 1164.12 for a gain of 2.55 points or 0.22 percent; and the Dow Jones U.S. Select Dividend Index which closed at 612.36 for a gain of 0.46 points or 0.08 percent.