U.S. stock futures are pointing higher in pre-market trading for Friday, October 14. The Dow Futures are at 18097.0 for a gain of 76.00 points. The S&P 500 Futures are at 2135.75 for a gain of 9.50 points. The Nasdaq Futures are higher at 4815.25 for a gain of 19.25 points. The Russell Futures are at 1220.1 for a gain of 6.10 points.

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 is at 16856.37 for a gain of 82.13 points or 0.49 percent. Hong Kong’s Hang Seng Index is at 23233.31 for a gain of 202.01 points or 0.88 percent. China’s Shanghai Composite is at 3063.81 for a gain of 2.46 points or 0.08 percent. India’s S&P BSE Sensex is at 27673.60 for a gain of 30.49 points or 0.11 percent. In Europe, the FTSE 100 is at 7032.41 for a gain of 54.67 points or 0.78 percent. Germany’s DAX is at 10586.68 for a gain of 172.61 points or 1.66 percent. France’s CAC 40 is at 4487.77 for a gain of 82.60 points or 1.88 percent. The Stoxx Europe 600 is at 340.49 for a gain of 4.87 points or 1.45 percent.

Friday’s Factors and Events

Stocks are pointing higher in pre-market trading as they recover from some overselling throughout the week. China’s exports and the FOMC minutes were lead catalysts for trading activity during the week.

On the economic calendar for Friday are the following reports: the Baker Hughes Rig Count, the Producer Price Index, Retail Sales, Business Inventories and Consumer Sentiment. Fed officials speaking on Friday include: Eric Rosengren, Loretta Mester and Janet Yellen.

The following stocks are trading actively in pre-market trading:

Cabot Oil & Gas Corp.

Symantec

Regions Financial

Fifth Third Bancorp

Staples Inc.

Norfolk Southern

Ulta Salon Cosmetics

Southwest Airlines

HCA Holdings

Delta Air Lines Inc.

Earnings season begins to pick up with large banks reporting on Friday. Investors will see earnings reports from JPMorgan, Citigroup and Wells Fargo.

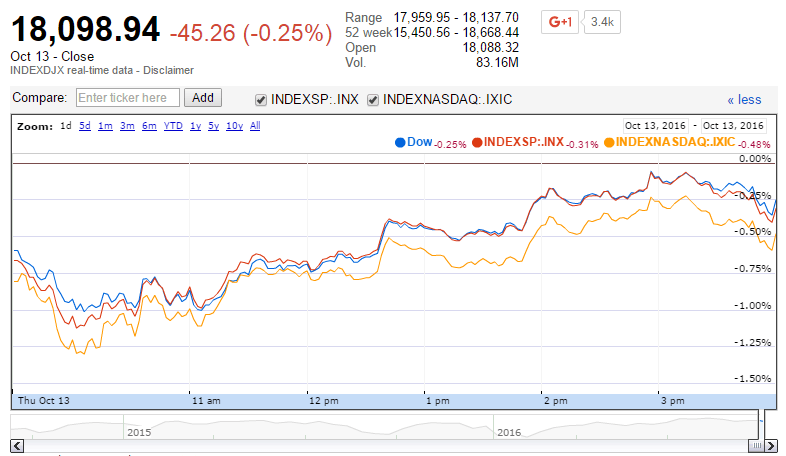

Thursday’s Activity

U.S. market indexes were lower Thursday. For the day the Dow Jones Industrial Average closed at 18098.94 for a loss of -45.26 points or -0.25 percent. The S&P 500 was also down, closing at 2132.55 for a loss of -6.63 points or -0.31 percent. The Nasdaq Composite closed lower at 5213.33 for a loss of -25.69 points or -0.49 percent.

Source: DJIA, S&P 500 and Nasdaq Composite. Google Finance.

Other notable index closes include the small-cap Russell 2000 Index at 1215.75 for a loss of -11.48 points or -0.94 percent; the S&P 600 Small-Cap Index at 737.65 for a loss of -7.85 points or -1.05 percent; the S&P 400 Mid-Cap Index at 1519.60 for a loss of -6.45 points or -0.42 percent; the S&P 100 Index at 946.42 for a loss of -3.20 points or -0.34 percent; the Russell 3000 Index at 1261.40 for a loss of -4.49 points or -0.35 percent; the Russell 1000 Index at 1181.58 for a loss of -3.64 points or -0.31 percent; and the Dow Jones U.S. Select Dividend Index at 601.44 for a loss of -0.82 points or -0.14 percent.