The news from France changed the atmosphere , and the crawling consolidation down we had for the last one and a half months has changed into a volatile price action with a gap up.

All the bearish setups that were in play got stopped out, and this is exactly the issue with bucking a strong trend on the first counter trend signals.

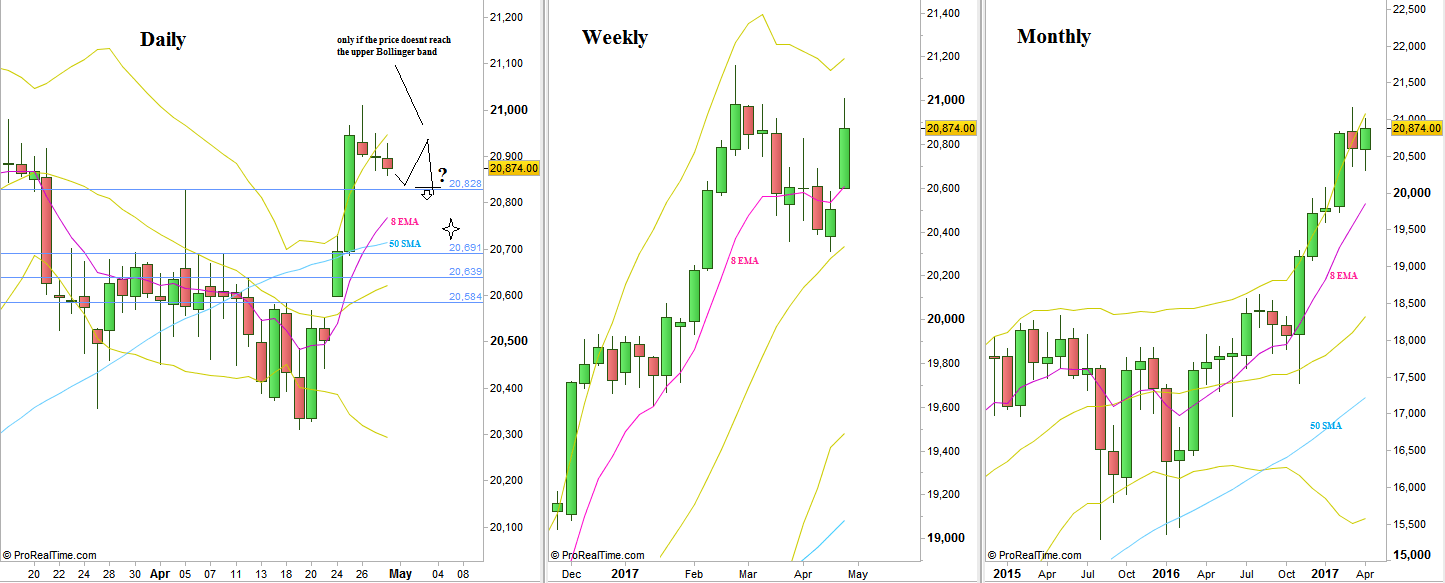

The Monthly bar closed rather bullish, but as a LL LH bar, not touching the upper Bollinger band, and it can be meaningful onward.

The current price action suggests further consolidation on the coming week, rather than continuing strongly higher. So any Daily move up to test the Weekly High again that doesn’t touch the Daily upper Bollinger band and reverses down instead – can be good for a small Short with a target of the same amplitude that had been made (See Daily chart).

Important support levels for the short term are indicated on the Daily chart (blue lines).

Dow Futures: Daily, Weekly and Monthly charts (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.