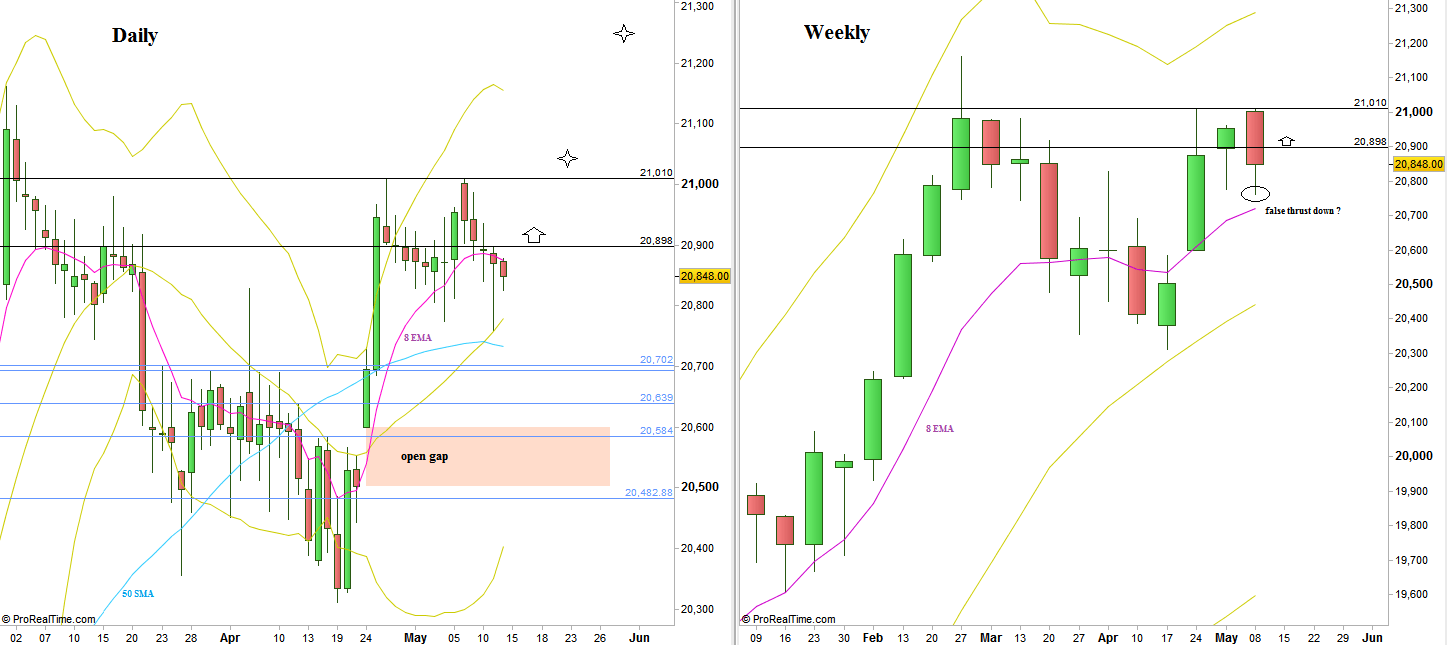

The passing week has extended the consolidation range, starting exactly at the High of 3 weeks ago at 21010, extending to the down side, a bearish week -but closing above important moving averages like the Daily 50 SMA and the Weekly 8 EMA.

The same bullish setup as mentioned in the passing week is still valid for the coming week: Taking out the Monthly High at 21010 is a bullish setup to reach 21250, that would be a new all time High.

However, the price action on the Daily timeframe over the passing week brought a more aggressive entry, the Bullish Pinbar on sloping 20 SMA of last Thursday. It is a good bullish signal once its High is taken out (while its Low remains respected!), not only by leaning on an inclined important moving average but mainly because that would signal by most chances a false thrust down on the Weekly timeframe, and a good indication that the price is going to test the upper side of the range once again. The target for this setup (if triggers) is above 21010 – at 21040, so most likely the other bullish setup with the target at the 21250 area level is going to be triggered as well.

The fact that the Daily 20 SMA has crossed the 50 SMA upwards, while the price has made a reaction through the crossing of these two MAs gives a good back wind to this setup upon triggering.

The next major target is quite far, and it is the Quarterly Spring of the last Quarter of 2016 (US elections) pointing at the 22400 level area as its target.

As for the bearish side, currently there is nothing to justify a bearish idea on the Daily and above timeframes. In case the coming Weekly bar takes out the High of 21010 but then closing weak back inside the range, a bearish idea can emerge be taking out its Low only on the week after.

Dow Futures: Daily and Weekly charts (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.