U.S. stock futures are higher in pre-market trading for Monday, July 4. The stock futures are trading until 1:00 PM EST while the broad market is closed for the Fourth of July holiday. The Dow Futures are up 35 points to 17901.0. The S&P 500 Futures are up 5.50 point to 2101.75. The Nasdaq Futures are up 8 points to 4441.25. The Russell Futures are showing a gain of 3.70 points at 1157.9.

In overnight trading in the Eastern Hemisphere stock trading was mixed with stocks in Asia trading higher while Europe traded mostly lower. In Asia, China’s Shanghai Composite traded higher at 2988.60 for a gain of 56.13 points or 1.91 percent. Japan’s Nikkei was higher at 15775.80 for a gain of 93.32 points or 0.60 percent. Hong Kong’s Hang Seng Index was higher at 21059.20 for a gain of 264.83 points or 1.27 percent. India’s S&P BSE Sensex was higher at 27268.34 for a gain of 123.43 points or 0.45 percent. In Europe, the FTSE 100 was lower at 6576.75 for a loss of -1.08 points or -0.02 percent. Germany’s DAX was lower at 9755.38 for a loss of -20.74 points or -0.21 percent. France’s CAC 40 was lower at 4257.80 for a loss of -16.16 points or -0.38 percent. The Stoxx Europe 600 was lower at 331.50 for a loss of -0.74 points or -0.22 percent.

The Week’s Factors and Events

Stock trading is closed on Monday for the Fourth of July holiday however the trading week will be a busy one for the U.S. market. For the week, the market focus will mainly be on the labor market which will report employment data for June on Friday. The Employment Situation report from the Bureau of Labor Statistics will be released on Friday morning at 8:30 AM EST. The expectation is for an increase of 180,000 jobs with an unemployment rate of 4.8 percent. This report follows May’s surprisingly low jobs report which showed an increase of only 38,000 jobs. The jobs report will be a key factor for indicating the direction of the economy and for monetary policy. On June 28, the Bureau of Economic Analysis released its final estimate of GDP which showed GDP increasing to 1.1 percent SAAR for the first quarter. With an improved GDP growth rate and inflation at stable levels, the jobs report is the final component helping to guide the direction of the U.S. broad market economy.

On Thursday, the ADP Employment report will be released for June at 8:15 AM EST. Also on Thursday, jobless claims will be reported for the week. The ADP Employment report is expected to show an increase of 150,000 jobs in the private sector. The jobless claims report is expected to show an increase of 1,000 claims for the week which would increase the total to 269,000. Both reports will supplement the final jobs report on Friday.

During the week, services will be in focus as the PMI Services Index report and ISM Non-Manufacturing Index report are both released on Wednesday. Also on Wednesday, the FOMC Minutes from its meeting on June 14 and 15 will be released. The Fed’s next meeting is July 26 and 27.

The number of earnings reports will also start to increase this week as company’s begin reporting their second quarter earnings.

Friday’s Activity

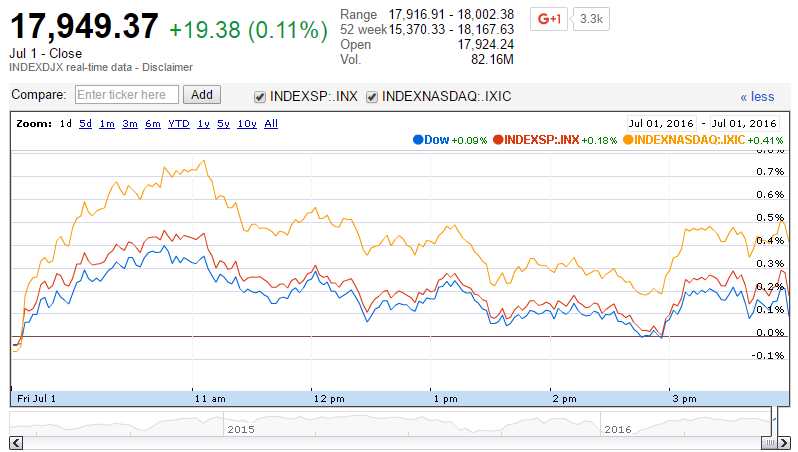

On Friday in the U.S., the leading indexes were higher. The Dow Jones Industrial Average closed at 17949.37 for a gain of 19.38 points or 0.11 percent. The S&P 500 was also higher, closing at 2102.95 for a gain of 4.09 points or 0.19 percent. The Nasdaq Composite closed higher at 4862.57 for a gain of 19.89 points or 0.41 percent.

Source: DJIA, S&P 500 and Nasdaq Composite. Google Finance.

Other notable index closes in the U.S. included the small-cap Russell 2000, closing at 1156.77 for a gain of 4.84 points or 0.42 percent; the S&P 600 closing at 710.17 for a gain of 1.81 points or 0.26 percent; the S&P 400 Mid-Cap Index closing at 1500.20 for a gain of 3.70 points or 0.25 percent; the Russell 3000 closing at 1239.52 for a gain of 2.90 points or 0.23 percent; and the Dow Jones U.S. Select Dividend Index closing at 612.36 for a gain of 0.46 points or 0.08 percent.